What is a General ledger?

General ledger (Definition)

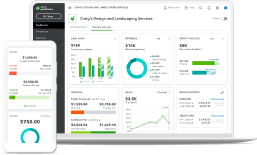

If you want to keep track of all your business's financial transactions in one place, a general ledger is the best place to start. The general ledger includes all the company’s financial accounts, which are then used to create important documents, such as balance sheet and profit and loss statement. It keeps track of all financial transactions accurately and helps you make a "trial balance," which means your books will balance when you're done with them. A general ledger is the foundation of a company's financial reporting, with all company transactions recorded. It includes things like assets (fixed and current), liabilities (accrued expenses, and customer deposits), revenues, profits, and losses. It also records equity, such as common stock, retained income, and treasury stock.