Income Statement Guide

In this article, you will learn:

- What is an Income Statement?

- Understanding the Income Statement

- Prepare an Income Statement

- Income Statement in Excel & PDF

- How to Write an Income Statement

- Sample Income Statement

- What’s the Difference Between a Balance Sheet and Income Statement?

- Revenues and Gains

- Expenses and Losses

- Income Statement Structure

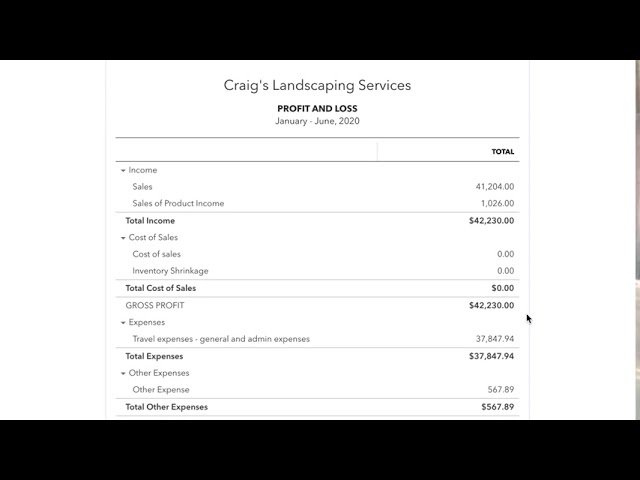

- Income Statement Example

- Reading Standard Statements

- Uses of Income Statements

What Is an Income Statement?

An income statement is one of your business’s most important financial statements and showcases the profit earned or losses incurred by your business during an accounting period.

An income statement, also known as the trading and P&L account or revenue and expense summary, reveals the performance of your business entity within a specific accounting period.

The profits earned or losses incurred by your business are determined by subtracting operating and non-operating expenses from the revenues your business generates.

Accordingly, such a statement showcases your company’s revenues, costs, gross profit, selling, administrative expenses, other income and expenses, taxes, and net profit in a standardised format.

Thus, an income statement summarises revenues, expenses, gains, and losses incurred by your business. An income statement begins with the sales generated by your business and ultimately determines the net profit earned or net loss incurred by your business.

Typically, your business’s income statement reveals how the revenues your business earns are turned into net earnings.

Understanding the Income Statement

As we mentioned earlier, an income statement is also referred to as a statement of operations, statement of earnings, statement of income, or profit and loss statement.

Such a statement can be prepared in two basic formats in financial reporting: single-step format and multi-step format.

Single-Step Income Statement Format

One of the formats used for the profit & loss statement or income statement is a single-step income statement. As the name suggests, this format of income statement just uses one step to calculate the net income.

This step involves subtracting expenses and losses from incomes and gains. A single-step income statement would look something like the following:

| Company A | |

| Income Statement | |

| For The Year Ended December 31, 2019 | |

| Revenues and Gains: | |

| Sales/Revenues | $200,000 |

| Interest Income | $10,000 |

| Gain from sale of assets | $5,000 |

| Total Revenues and Gains | $215,000 |

| Expenses and Losses: | |

| Cost of Goods Sold | $50,000 |

| Commission Expense | $10,000 |

| Office Supplies | $5,000 |

| Office Equipment Expense | $3,000 |

| Advertising Expense | $7,000 |

| Interest Expense | $1,500 |

| Loss From Lawsuit | $500 |

| Total Expenses and Losses | $77,000 |

| Net Income | $138,000 |

Multi-Step Income Statement Format

The next format used for preparing an income statement is the multi-step income statement format. As the name suggests, a number of subtractions must be undertaken to calculate the net income.

The multi-step income statement categorises revenues, gains, expenses, and losses into operating and non-operating items.

Furthermore, it also showcases Gross Profit which is the Sales minus the Cost of Goods Sold. It’s important to remember that the income statement records revenues or expenses on the accrual basis of accounting, which is when such income or expenses occur and not when cash is received or paid.

When accrual accounting is used, the accounting events that are recorded in the income statement do not necessarily match the actual cash received or paid.

So, when it comes to your income statement, the profit earned or loss is what’s incurred over an accounting period, not your cash flow.

Therefore, a multi-step income statement would look something like this.

| Company A | ||

| Income Statement | ||

| For The Year Ended December 31, 2019 | ||

| Sales/Revenues | $200,000 | |

| Less: Cost of Goods Sold | $50,000 | |

| Gross Profit | $150,000 | |

| Operating Expenses: | ||

| Selling Expenses | – | |

| Advertising Expense | $7,000 | |

| Commission Expense | $10,000 | $17,000 |

| Administrative Expenses | ||

| Office Supplies | $5,000 | |

| Office Equipment Expense | $3,000 | $8,000 |

| Total Operating Expenses | $25,000 | |

| Operating Income | $125,000 | |

| Non-Operating and Other | ||

| Interest Revenue | $10,000 | |

| Gain from Sale of Assets | $5,000 | |

| Interest Expense | ($1,500) | |

| Loss from Lawsuit | ($500) | |

| Total Non- Operating | $13,000 | |

| Net income | $138,000 | |

Prepare an Income Statement

Typically, business entities use a multi-step income statement format to arrive at their net income. The multi-step income statement specifies the Gross Profit amount. The Gross Profit amount is an important metric used by various stakeholders to keep track of the Gross Profit Margin, that is, the Gross Profit as a percentage of Net Sales.

Furthermore, the Multi-Step Income Statement clearly states the operating income of your business that showcases how much profit your business has earned from its core business activities during a specific accounting period.

Therefore, to prepare the income statement for your business, you need to report the revenues, expenses, and subsequent profits or losses within a specific accounting period.

The following are the steps to prepare an income statement for your business.

Choosing an Accounting Period

The first step in preparing an income statement for your business is to select the accounting period for which you need to prepare the income statement. Business entities commonly prepare income statements on a monthly, quarterly, or annual basis.

Publicly listed companies are mandated to prepare financial statements on a quarterly and annual basis, whereas, small businesses are not required to follow such strict reporting rules.

Producing a Trial Balance Report

Using cloud-based accounting software, you can easily generate a trial balance report. Trial balance provides the closing balances of all the ledger accounts on a specific date and is the first report needed to prepare all of a business’s financial statements.

So, to prepare an income statement, you will first need to generate the trial balance report.

Reporting Revenues

The next step in preparing an income statement is to determine the total sales revenue for that accounting period. Revenues include the amount earned for the goods sold or the services rendered during the specific accounting period.

As stated above, an income statement is prepared on an accrual basis of accounting. So these revenues include the amount earned regardless of whether the cash is received or not.

Therefore, you need to take a total of all the revenue items from the trial balance and enter the same sum in the revenue section of your income statement.

Assessing the Cost of Goods Sold

The cost of goods sold includes the direct costs of producing the goods or services to be sold by your business. It covers material, labour, and overhead costs that are directly used to produce the goods and services sold by your business. It does not include any indirect costs like selling and distribution, etc.

The COGS Formula is: COGS = Opening Stock + Purchases + Direct Expenses – Closing Stock

Therefore, all you need to do is account for these items that form part of COGS from the trial balance report, calculate COGS, and put the resulting figure in the COGS section of the income statement.

Determine Gross Profit

Gross profit is the profit that your business earns after deducting the costs related to producing and selling goods and services from your business revenues.

The gross profit of your business indicates how efficient your business is in utilising raw material, labour, and overheads in producing goods and services.

You must remember that to calculate gross profit, only variable costs are taken into consideration, meaning the costs that change with the change in the level of output.

Fixed costs such as rent, insurance, etc. are not considered while calculating gross profit as these costs are not directly associated with producing goods and services.

Calculating Operating Expenses

Operating expenses are the expenses incurred by your business in order to run its normal course of operations such as payroll, rent, office supplies, etc. Thus, you need to add all the operating expenses specified in the trial balance report and enter the same expenses in the income statement as selling and administration expenses.

Determine Operating Income

Operating income is the amount of profit that your business generates from its normal business operations. This income is calculated after deducting all the operating expenses from the gross profit.

This amount showcases how much your business is earning from normal business operations. That is, how much your business can earn before any non-operating income or expenses like interest, tax, etc.

Financial analysts make use of operating income rather than net income to measure the profitability of your business.

Interest Expense

Interest is the cost of borrowing your business entity. Business entities typically show interest expense and interest income as a special line item in the income statement. This is typically undertaken to show earnings before interest and tax and earnings before tax.

Calculate Non-Operating Expenses, Income, and Others

Non-operating expenses are the expenses that are incurred by your business but are not related to your core business operations. Examples of non-operating expenses include loss on the sale of fixed assets (where buying and selling such fixed assets is not a part of your core business activity).

Likewise, non-operating income is the income not earned from core business activity. For example, profit on the sale of investments, gain on the sale of fixed assets, etc.

Thus, after determining the operating income, you need to assess non-operating income and expenses. Simply find out these items on the trial balance and include them in the income statement as non-operating income, expense, and others just below the operating income.

Calculate Pre-Tax Income

Pre-tax income is the amount of money earned after all the operating expenses as well as interest and depreciation have been subtracted from the revenues of your business but before reducing income tax.

Pre-tax income gives financial analysts an understanding of your business entity’s financial performance before taking into account the effect of the tax.

Business entities may choose to track pre-tax earnings over net income as it is a better measure to evaluate business performance. This is because things such as tax deductions vary from year to year and can impact business earnings, thus not giving a true and fair view of the profitability of your business.

Special or Extraordinary Items

Special items on the income statement are one-time expenses or incomes that your business does not expect to spend or earn again in the future. One-time expenses or incomes include restructuring fees, gain on winning a lawsuit, etc.

Financial analysts consider these special items when comparing profits year-to-year as these special items are important to consider in order to know the true profitability of the business. Therefore, you need to include these special items on the income statement to calculate net income.

Income Taxes

The next step is to estimate the income taxes to be paid by the business entity. The income tax amount is not the amount that is paid by your business. Rather, it is just an estimation of the amount of taxes that your company is expected to pay.

Calculate Net Income

Net income is the most important metric used by financial analysts to know the profitability of a business entity. When expenses exceed income, the net profit becomes negative, meaning you incur a net loss.

Thus, you need to deduct income tax from the pre-tax income to calculate the net income of your business. Net income is the amount that goes into the retained earnings of your balance sheet after paying out dividends if any.

Income Statement in Excel & PDF

How to Write an Income Statement

To prepare an income statement, you first need to generate a trial balance report. This report is a prerequisite for preparing all financial reports as it contains the closing balances of all the ledger accounts on a specific date.

An Income statement focuses on these four items: revenues, gains, expenses, and losses. You need to report all these items in order to prepare an income statement for a given accounting period.

The steps involved in an income statement are as follows:

- Generate the trial balance report for the given accounting period.

- Report sales revenue earned by selling goods and services for the given accounting period.

- Calculate the COGS, which is the direct cost of producing goods and services.

- Calculate gross profit by subtracting COGS from the sales revenue.

- Assess operating expenses, which are expenses associated with running the day-to-day activity of your business.

- Calculate operating income, which is income your business entity is able to earn from normal business operations. This is calculated by subtracting operating expenses from the gross profit.

- Determine the interest expense and interest income. Subtract interest expense or add expense revenue to the operating income.

- Calculate other non-operating expenses and income such as gain or loss on the sale of investments.

- Determine pre-tax income. Pre-tax income is calculated by subtracting the sum of non-operating expenses and income from operating income.

- Now, calculate income tax and include it in the income statement right below the pre-tax income.

- Finally, calculate the net income by subtracting the tax from the pre-tax income.

Sample Income Statement

Here’s a sample income statement of company ABC for the year ending 31st December 2020 and 31st December 2021.

| Particulars | 2018 (in $) | 2019 (in $) |

| Net Sales | 3,000,000 | 4,000,000 |

| Cost of Sales | (200,000) | (100,000) |

| Gross Profit | 2,800,000 | 3,900,000 |

| Operating Expenses | (250,000) | (300,000) |

| Operating Income | 2,550,000 | 3,600,000 |

| Other Income and Expenses | 50,000 | 60,000 |

| Extraordinary Gains or Losses | (10,000) | (20,000) |

| Interest Expense | (25,000) | (30,000) |

| Net Profit Before Tax | 2,565,000 | 3,610,000 |

| Taxes | (400,000) | (300,000) |

| Net Income | 2,165,000 | 3,310,000 |

What’s the Difference Between a Balance Sheet and Income Statement?

Both the balance sheet and income statement form part of the fundamental financial statements that are prepared to understand the financial standing of a business entity.

However, both the balance sheet and income statement differ in several aspects which are as follows:

Contents Summarised

A balance sheet records assets, liabilities, and shareholder’s equity. That is, it calculates what your company owns and the amount it owes together with the amount that is invested by the shareholders of the company. Income statements record revenues, gains, expenses, and losses in order to determine the net profit earned or net loss incurred by your business. It provides a summary of revenues, costs, and expenses incurred by your business during a specific accounting period.

Time of Reporting

A balance sheet showcases the financial position of your business at one point in time whereas an income statement reveals your business’s performance over a period of time. For instance, financial statements for the month of January 2020 would consist of a balance sheet as of January 31, 2020, and a monthly Income Statement for the entire month of January 2020.

Use of Financial Statements By Stakeholders

A balance sheet is used by the management to understand if your business has enough liquidity to meet its financial obligations. Thus, the users of the balance sheet like investors and creditors get a fair idea of how effectively the management of the company uses its assets. The income statement lets a business know more about its operational performance so that it can understand what needs to be fixed.

Creditors, investors, and lenders use balance sheets to understand the debt position of your business and analyse if they can give more credit to your firm. On the other hand, the Income Statement is used by such stakeholders to see if the company is making enough profits to pay off its debts.

Thus, the Profit or Loss Statement or Income Statement provides details to the financial analysts and investors regarding the capability of your business to generate profit either by increasing the sales, by controlling expenses, or both.

Financial Indicators

Various components of a balance sheet are analysed to understand the liquidity position of your business, whereas various sections such as gross profit, operating income, and net income in the income statement are compared to sales to understand gross profit margin, operating income, and net income as a percentage of sales.

Revenues and Gains

Two of the components of an income statement include revenues and gains. These are further categorised into operating and non-operating revenues from other sources.

Operating Revenue

Operating revenue is the revenue that your business generates from its primary or core business activities. What constitutes an operating revenue varies depending on the type of business as well as the industry your business is in.

For example, a doctor derives operating revenue by providing medical treatment whereas a manufacturer of furniture generates operating revenue through sales of such furniture.

Non-Operating Revenue

Non-operating revenue is the part of your revenue that is produced from secondary activities, such as activities that do not form part of your core business operations.

For example, such activities may include investing surplus cash in interest-bearing investments that are not associated with primary business operations and earning interest income, dividend income, etc.

Gains

Gains typically include the sale of property, plant, and equipment for a cash amount that exceeds the book value of the asset being sold. For example, selling machinery for an amount of cash that is higher than the book value of machinery.

Expenses and Losses

Expenses and losses are the costs incurred by your business in order to run its normal business operations and generate profits. Expenses are also categorised into operating and non-operating expenses.

Operating Expenses

Operating expenses are the costs incurred to run the normal operations of your business. These expenses include inventory costs, insurance, rent, payroll, etc.

Non-Operating Expenses

These are the expenses associated with the activities outside the main operations of your business, such as interest paid on debt.

Losses

Losses are the one-time costs incurred by your business from the activities not associated with its core activities. For example, loss on the sale of an asset, loss in a lawsuit, etc.

Income Statement Structure

As stated earlier, an income statement helps in knowing how your business can transform revenues into profits for a given accounting period. Accordingly, the net income of your business is calculated as follows:

Net Income = (Revenues + Gains) – (Expenses and Losses)

In order to have a better understanding of the structure of an income statement, let’s consider the example given under the single-step income statement format.

Company A earns a revenue of $200,000 from sales during the year 2019. It incurred various expenses such as the cost of goods sold, office supplies, etc. that amounted to $77,000. It earned gains from the sale of assets amounting to $5,000 and incurred a loss from a lawsuit of $500 during the year 2019.

The net income thus earned by Company A was $138,000 for the year ending on December 31, 2019. This example illustrates the simplest manner of generating income statements for any business entity.

As the name suggests, it is a single-step income statement that includes one subtraction, that is, subtracting the sum of expenses and losses from the sum of revenues and gains.

However, bigger companies have diverse business segments and divide an income statement into various sections such as operating and non-operating revenues and expenses, gains and losses, and provide more information through such statements to the various stakeholders.

Furthermore, in the multi-step income statement, different indicators of the profitability of the business entity are captured at different levels such as gross profit, operating income, pre-tax income, and after-tax income.

This helps stakeholders understand how much income your business is generating at various levels. For example, a higher gross profit figure and a lower operating income figure reveal that your business is incurring an increased amount of operating expenses.

Similarly, a higher pre-tax income and a lower after-tax income showcases that one-time costs are taking a toll on your business earnings.

Reading Standard Income Statements

The standard income statement format emphasizes the calculation of income at each sub-head level such as gross profit, operating income, pre-tax income, and after-tax income to determine net profit which forms part of retained earnings after distributing dividends.

Let’s take the example of Microsoft’s income statement to understand how to read a standard income statement.

Gross Profit

The first part of the income statement reveals the gross profit earned by Microsoft from the years 2016 to 2020. In 2020, the company earned a gross profit of $96.94 Billion.

This is calculated by deducting COGS worth $46.08 Billion from the Revenue of $143.02 billion. Thus, the cost of producing goods is 32.2% of total sales which means that 32.2% of the total sales is the cost of generating such revenues.

Operating Expenses

The next part of the income statement is known as operating expenses. Operating expenses also take into account both COGS and total revenue to calculate operating income.

The total operating expenses of Microsoft in 2020 are calculated by adding SG&A expenses worth $43.98 billion and other operating expenses worth NIL. Thus, operating income is calculated by subtracting operating expenses of $43.98 billion from the total revenue of $143.02 billion, which turns out to be $99.04 billion.

This is operating income or EBIT before taking into account the unusual expense of $123 million. Thus, operating income or EBIT after the unusual expense is $53.08 billion.

Income From Business Operations

The next part of the income statement calculates income from business operations. Income from business operations takes into account net other income or expenses like interest expense and taxes to determine net income from business operations.

Thus, after considering all non-operating income and expenses, we are left with net income which forms part of the retained earnings in the balance sheet.

Microsoft has a net income of $44.28 billion which is calculated by adding net other income to operating income or EBIT.

Uses of Income Statements

To Know Profitability

As stated earlier, the main purpose of an income statement is to reveal the operational performance of a business entity. That is, how much profit it has earned or the loss it has incurred in an accounting period.

To Determine Financial Indicators

In addition to this, there are various sections in the income statement that can help the users of such a statement understand how revenue generated from sales is transformed into net income or a net loss. For instance, the gross profit helps the management to set the retail price of a product or service, considering the prices offered by competitors.

Setting Price

The management experiments with various price points to see which price earns the company maximum profits. In addition to this, management also gains an understanding of the cost incurred in producing goods and services and how it can regulate the same.

To Know Capacity to Generate Operating Income

The next section is the operating income, which is calculated by subtracting the operating expenses from the gross profit. This helps the users of the financial statements understand the capability of the company to generate profits before taking into account the impact of the financing activities.

Using For Internal Purposes

Furthermore, income statements can be prepared for internal purposes. For instance, management can get useful information about various departments and business segments if Income Statements are prepared for each of them regularly.

Making Key Decisions

Similarly, depending on the income statements, the management can take important decisions like increasing sales, discontinuing a product or a service, adding new geographical locations, etc.

To Know Year-On-Year Performance

Finally, financial analysts also use income statements to gain an understanding of the year-on-year performance of the business.

If you are a small business owner, a freelancer, or a sole trader ready to start working on your income statement, start your 30 days trial with QuickBooks Online.

Frequently Asked Questions about Income Statement

What is a single-step income statement?

A single-step income statement is one of the formats for profit & loss statements that involves just one step to determine the net income of your business. This step involves subtracting expenses and losses from incomes and gains.

What is a common-size income statement?

A common size income statement is an income statement in which each line item is represented as a percentage of sales or revenues generated by your business. Such an income statement helps to understand and compare the financial performance of the business entity over different accounting periods.

What is an income statement with an example?

An Income Statement is a statement of operations that captures a summary of the performance of your business within a given accounting period. It reveals your business’s revenues, costs, Gross Profit, Selling and Administrative Expenses, taxes, and Net Profit in a standardised format. For example, if revenues and gains are worth $215,000, and Expenses and Losses are worth $77,000, the Net Income turns out to be $138,000.

Why is an income statement important?

An Income Statement is one of the fundamental financial statements that help determine your business’s ability to generate profits within a given accounting period. It helps the users of this financial statement to understand how revenues generated from sales were transformed into Net Income or Net Loss.

What does an income statement look like?

An Income Statement can be prepared in a Single-Step format that calculates the Net Income by subtracting expenses and losses from revenues and gains. However, in a Multi-Step Income Statement, the Income Statement is divided into various sections like Gross Profit, Operating Income, Pre-Tax Income, and After-Tax Income to calculate Net Profit.

Are the income statement and profit and loss the same?

An Income Statement is also known as Revenue and Expense Summary, Trading and Profit & Loss Account, Statement of Income, Statement of Earnings, Statement of Operations, and Statement of Operating Results. Thus, both the Income Statement and the Profit and Loss Statement are the same document, meaning the Profit and Loss Statement is another commonly used term for the Income Statement.

What are the 3 sections of an income statement?

The first section comprises Revenues, also known as the Topline. The next section includes expenses, which are the Cost of Goods Sold, Operating Expenses, and Other Expenses. The next section is the Net Income which is calculated by subtracting all the expenses from the revenues.

How do you explain an income statement?

An Income Statement is one of the fundamental financial statements that reveal your business’s revenues and expenses within a certain accounting period. In addition to this, it also showcases the operational performance of your business over a certain accounting period.

How do you complete an income statement?

There are several steps to completing an Income Statement. These include choosing an accounting period, generating a Trial Balance, determining revenues, calculating COGS, calculating Gross Margin, reporting operating expenses, determining operating income, adjusting income taxes, and calculating Net Income.

What makes a strong income statement?

A strong income statement solves the main purpose of reporting your company’s ability to generate profits within a certain accounting period. Thus, it reports on the success or failure of your business over time.

How do you explain a profit and loss statement?

A Profit and Loss Statement is one of the fundamental financial statements that reveal your business’ revenues and expenses within a certain accounting period. In addition to this, it also showcases the operational performance of your business within a certain accounting period.